Introduction

Our Loan Eligibility Checker Platform is designed for NBFCs (Non-Banking Financial Companies) and financial consultants to streamline the loan application process while protecting the client’s credit score. This innovative solution ensures soft inquiries on CIBIL, avoiding negative impacts on credit scores, and provides a seamless experience for assessing loan eligibility.

Key Features and Modules

1) Soft Inquiry Mechanism

Integration with third-party APIs to perform soft inquiries on CIBIL.

Integration with third-party APIs to perform soft inquiries on CIBIL.

No hard inquiries, ensuring the client’s credit score remains unaffected.

No hard inquiries, ensuring the client’s credit score remains unaffected.

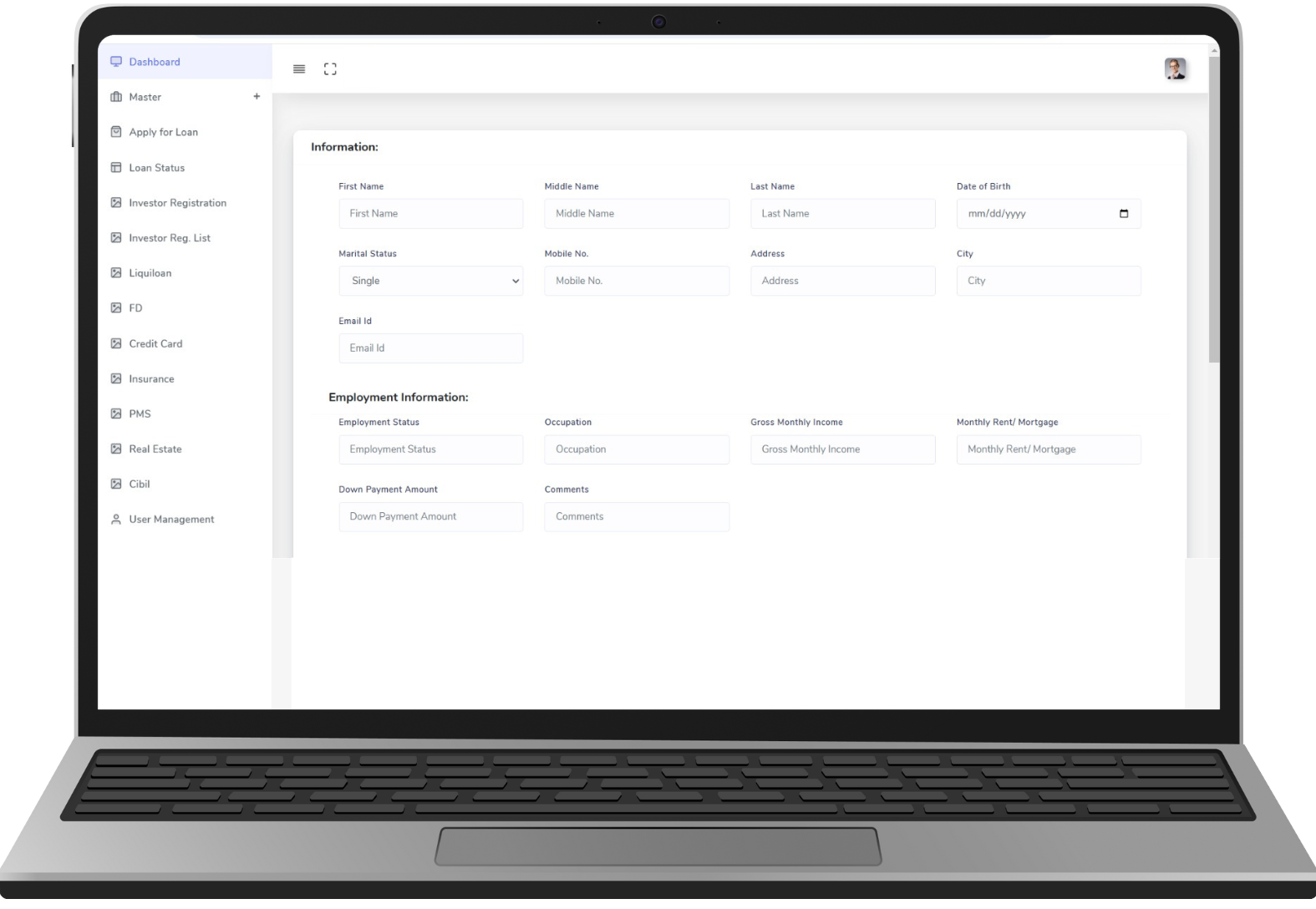

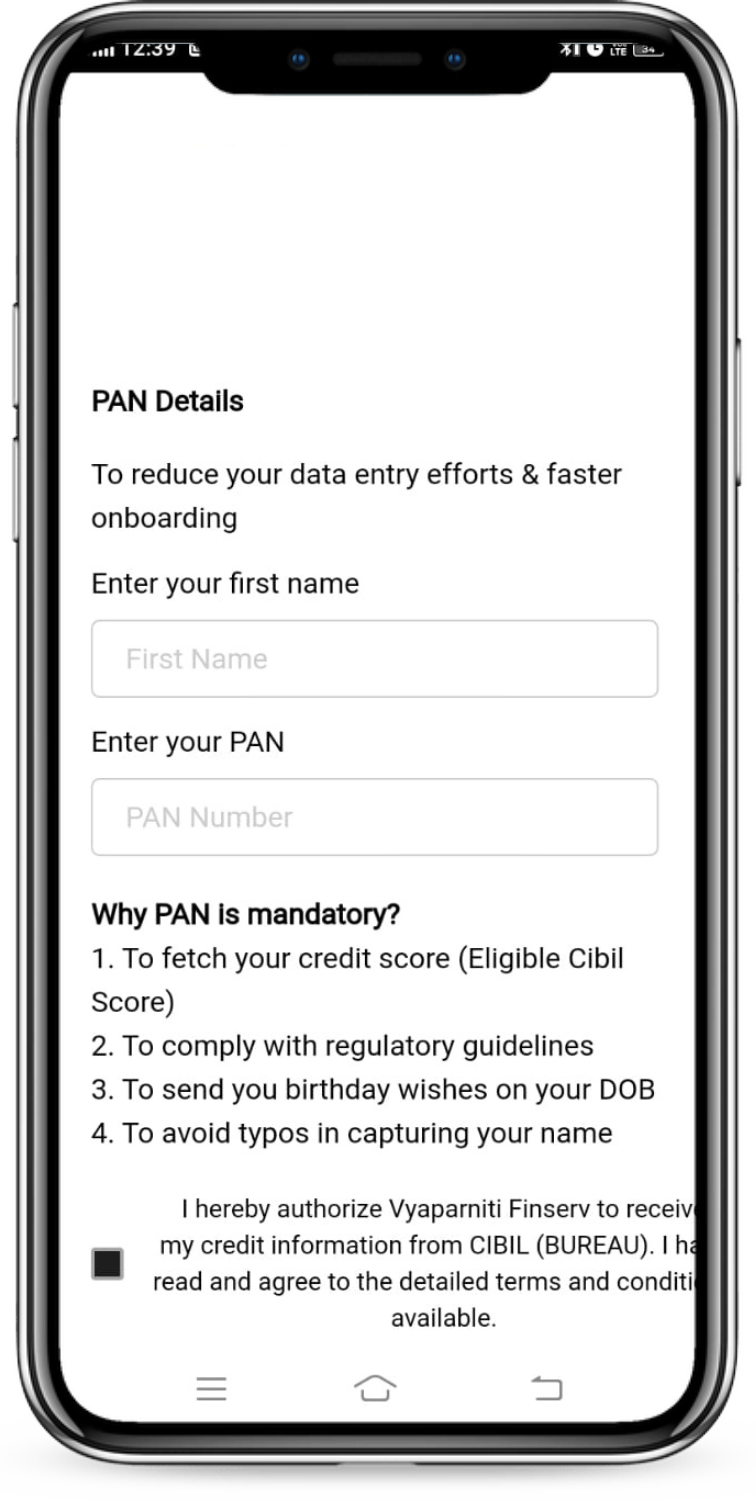

2) Comprehensive Document Management

Modules for collecting and verifying necessary documents:

Modules for collecting and verifying necessary documents:

♦ PAN card ♦ Aadhaar card ♦

Address details

♦ Bank account details

Secure storage and easy retrieval of uploaded documents.

Secure storage and easy retrieval of uploaded documents.

3) Automated Data Fetching

Fetch previous loan details, current CIBIL score, and financial history via

integrated APIs.

Fetch previous loan details, current CIBIL score, and financial history via

integrated APIs.

Generate a comprehensive profile for loan eligibility assessment.

Generate a comprehensive profile for loan eligibility assessment.

4) Loan Eligibility Analysis

Analyze client data to determine loan eligibility for various financial

institutions.

Analyze client data to determine loan eligibility for various financial

institutions.

Match client profiles with suitable loan offers from multiple NBFCs and banks.

Match client profiles with suitable loan offers from multiple NBFCs and banks.

5) Customizable Modules

Tailored workflows to align with specific requirements of NBFCs and consultants.

Tailored workflows to align with specific requirements of NBFCs and consultants.

Flexible integration with additional APIs as needed.

Flexible integration with additional APIs as needed.

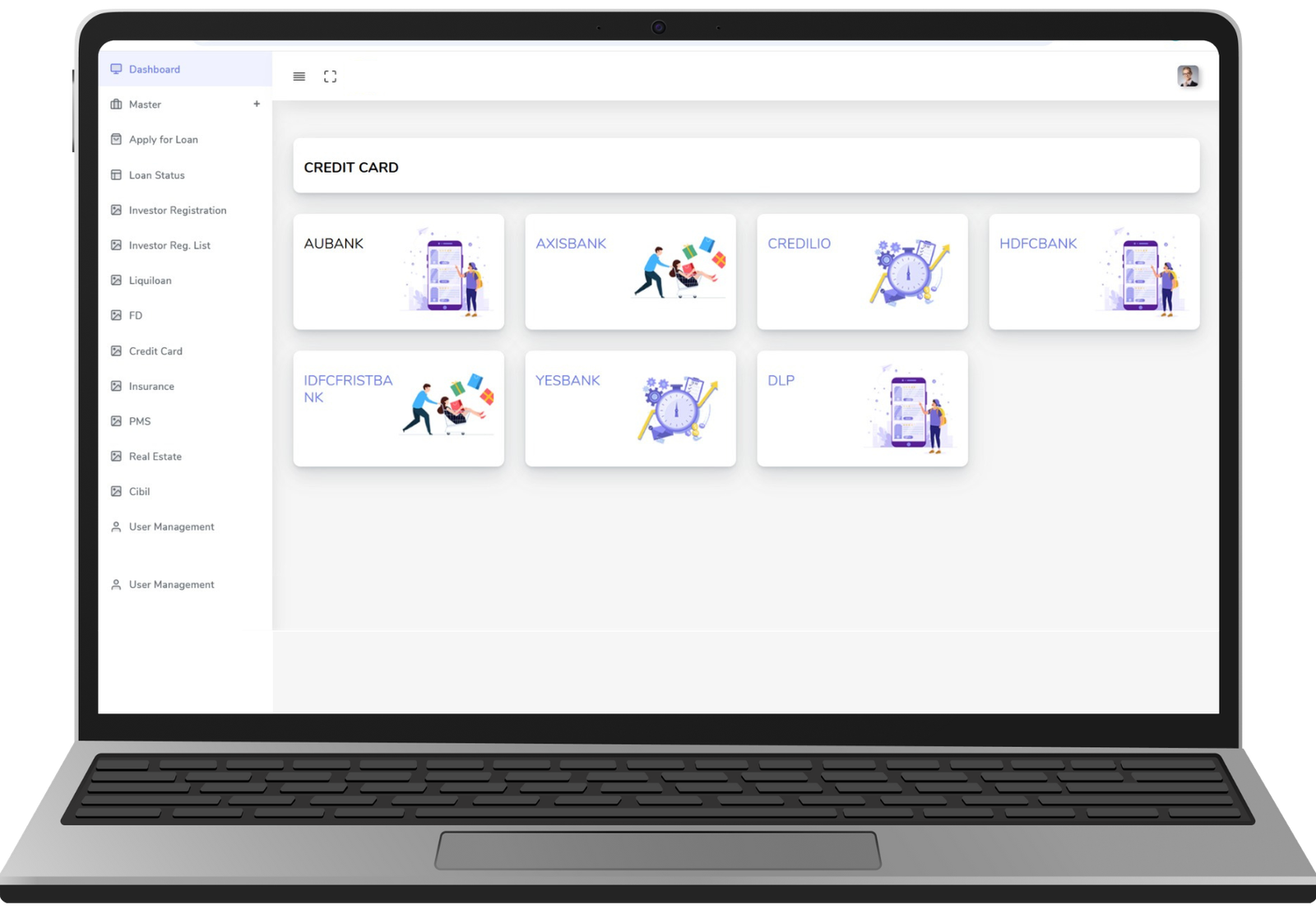

6) Client Dashboard

User-friendly interface for document uploads and loan eligibility tracking.

User-friendly interface for document uploads and loan eligibility tracking.

Real-time updates on application progress.

Real-time updates on application progress.

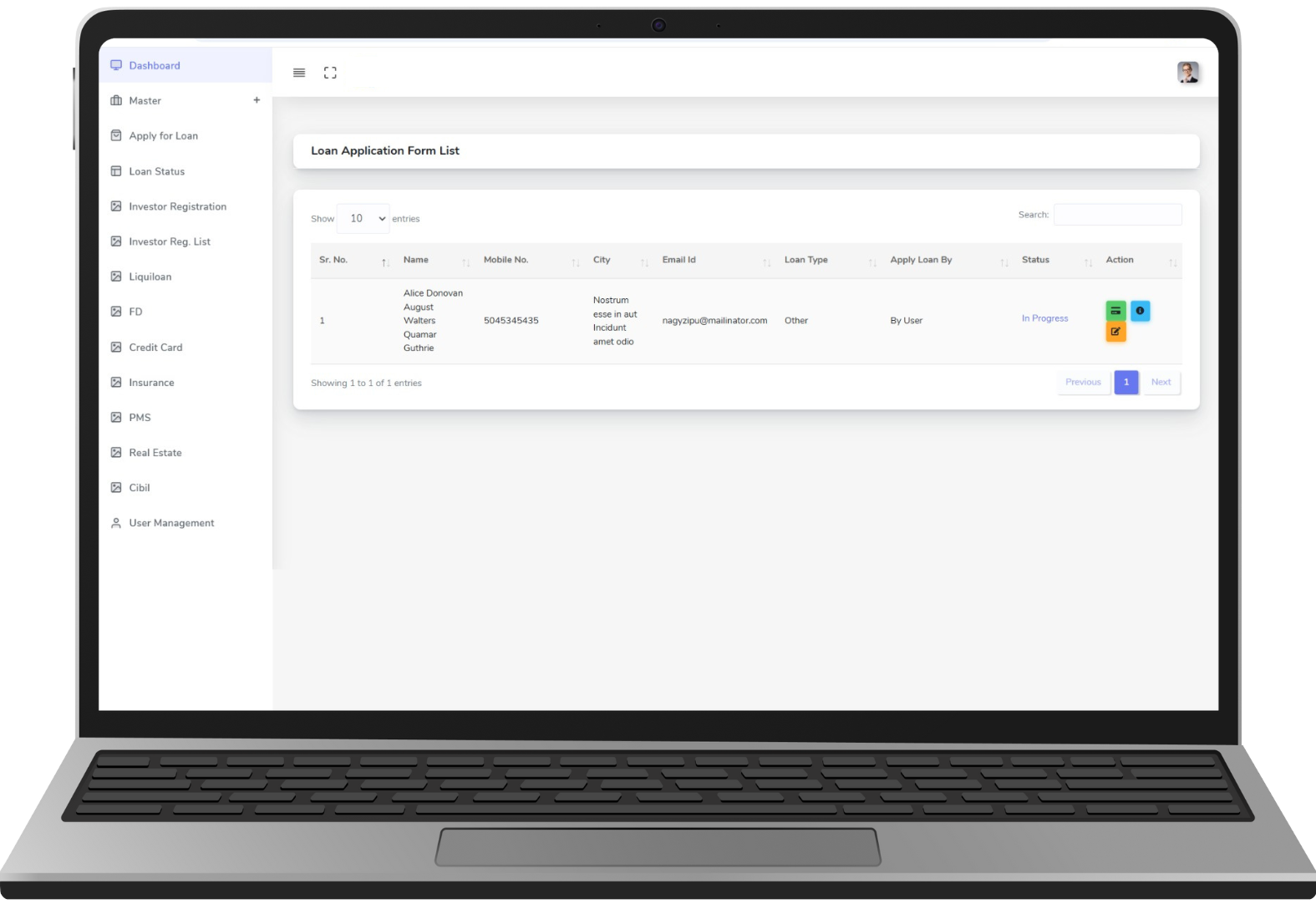

7) Admin Panel

Tools for handling client inquiries, tracking API integrations, and generating reports.

Tools for handling client inquiries, tracking API integrations, and generating reports.

Secure, centralized platform for consultants and NBFCs to manage loan applications.

Secure, centralized platform for consultants and NBFCs to manage loan applications.

Benefits of the Solution

CIBIL Score Protection: Soft inquiries ensure no adverse impact on credit

scores.

CIBIL Score Protection: Soft inquiries ensure no adverse impact on credit

scores.

Time-Saving: Streamlined processes for collecting and analyzing client

information.

Time-Saving: Streamlined processes for collecting and analyzing client

information.

Transparency: Clear and real-time updates for clients on their loan

eligibility.

Transparency: Clear and real-time updates for clients on their loan

eligibility.

Accuracy: Automated data fetching reduces manual errors and speeds up

decision- making.

Accuracy: Automated data fetching reduces manual errors and speeds up

decision- making.

Scalability: Easily adaptable for multiple financial institutions and

changing regulations.

Scalability: Easily adaptable for multiple financial institutions and

changing regulations.

Software Workflow

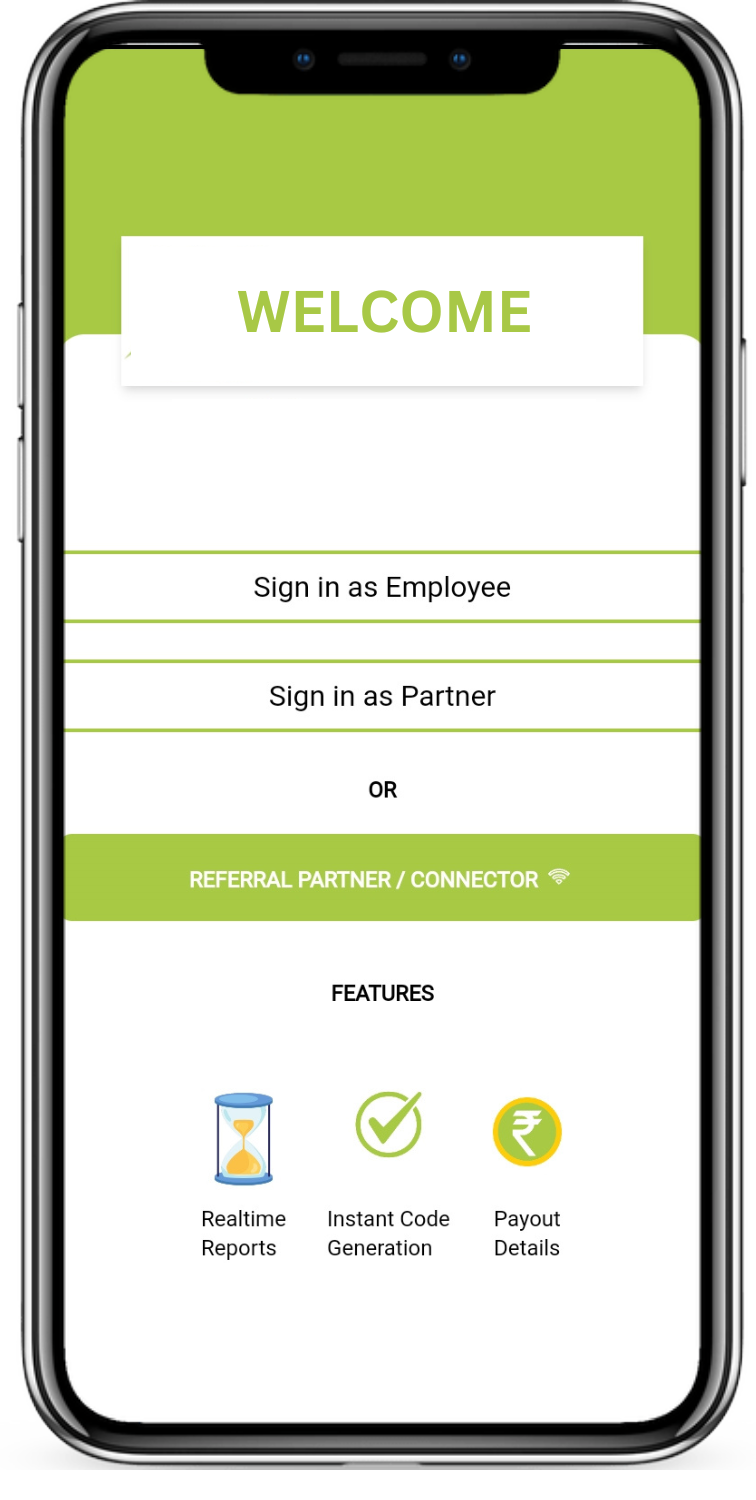

1) Client Onboarding:

Client registers on the platform and uploads required documents.

Client registers on the platform and uploads required documents.

Details like PAN, Aadhaar, and address are verified via APIs.

Details like PAN, Aadhaar, and address are verified via APIs.

2) Data Fetching and Analysis:

Platform fetches client’s financial history and CIBIL score using integrated APIs.

Platform fetches client’s financial history and CIBIL score using integrated APIs.

Loan eligibility is assessed based on collected data.

Loan eligibility is assessed based on collected data.

3) Loan Matching:

System matches the client’s profile with appropriate loan options from financial

institutions.

System matches the client’s profile with appropriate loan options from financial

institutions.

Recommendations are shared with the client for further action.

Recommendations are shared with the client for further action.

4) Admin Oversight:

Admin monitors inquiries, manages data, and ensures smooth operation of the

platform.

Admin monitors inquiries, manages data, and ensures smooth operation of the

platform.

Detailed reports are generated for performance tracking and compliance.

Detailed reports are generated for performance tracking and compliance.

Conclusion

Our IBC/Survey/Election Voting Platform provides a comprehensive solution for secure and efficient voting processes. With features designed to meet the unique needs of professionals and organizations, we offer a platform that combines simplicity, flexibility, and reliability. Choose us as your trusted partner to experience the excellence and transparency that our solution brings to the voting process.

We look forward to discussing this proposal further and tailoring the platform to meet your specific requirements. Please reach out for a demonstration or additional inquiries.