Introduction

Our Property Valuation Consultant Platform is designed to streamline property valuation and field inquiry processes for banks and their associated property valuers. This platform enhances operational efficiency by providing role-based modules, mobile accessibility, and tailored reporting capabilities. It empowers banks to track cases, ensures seamless collaboration among stakeholders, and generates standardized reports for informed decision-making

Key Features and Modules

1) Bank Portal

Real-time tracking of cases associated with the bank.

Real-time tracking of cases associated with the bank.

Access to property valuation reports prepared by valuers.

Access to property valuation reports prepared by valuers.

Seamless communication with valuation authorities.

Seamless communication with valuation authorities.

2) Admin Panel

Role-based access control for secure and efficient management.

Role-based access control for secure and efficient management.

Case assignment to valuers and monitoring of progress.

Case assignment to valuers and monitoring of progress.

Provision to oversee operational workflows and ensure compliance.

Provision to oversee operational workflows and ensure compliance.

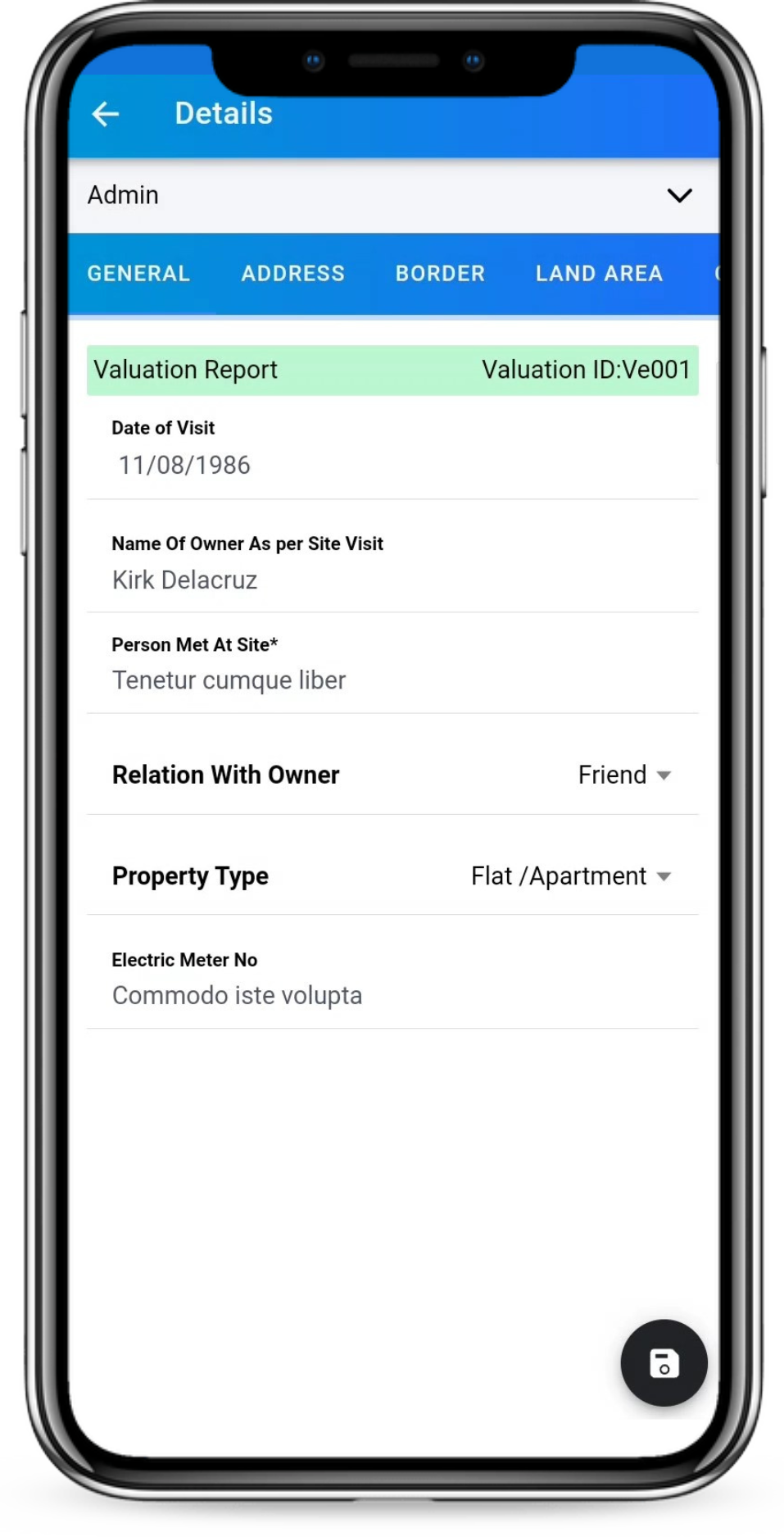

3) Valuation Workflow

Data from field executives is reviewed and validated by valuation authorities.

Data from field executives is reviewed and validated by valuation authorities.

Option for revisits, if necessary, to gather additional information.

Option for revisits, if necessary, to gather additional information.

Multi-level authority review ensures thorough and accurate property valuation.

Multi-level authority review ensures thorough and accurate property valuation.

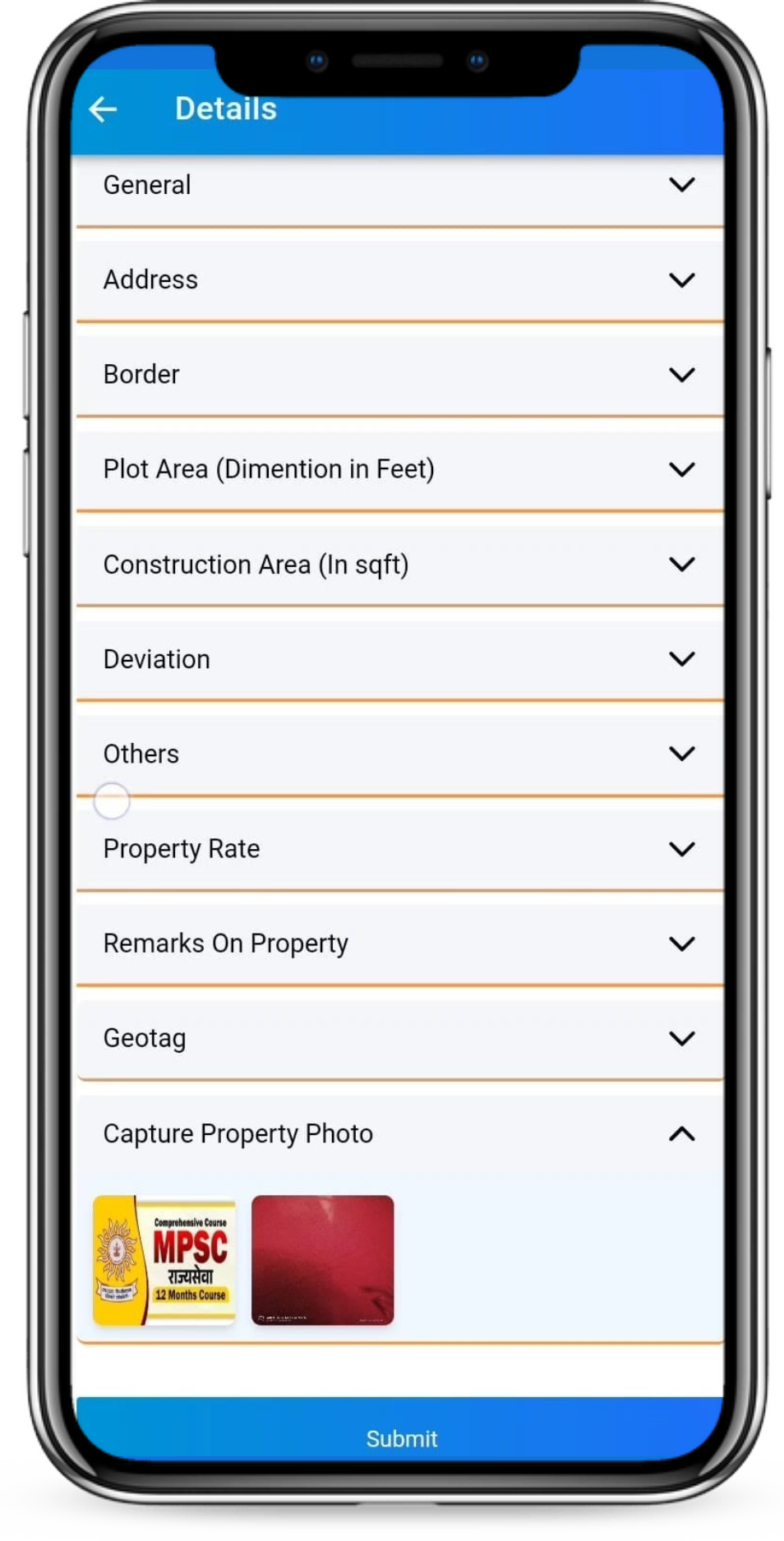

4) Mobile Application

For Valuers:

Receive and manage field inquiry cases.

Receive and manage field inquiry cases.

Fill detailed valuation information during site visits.

Fill detailed valuation information during site visits.

Assign cases to field executives for further inspection.

Assign cases to field executives for further inspection.

For Field Executives:

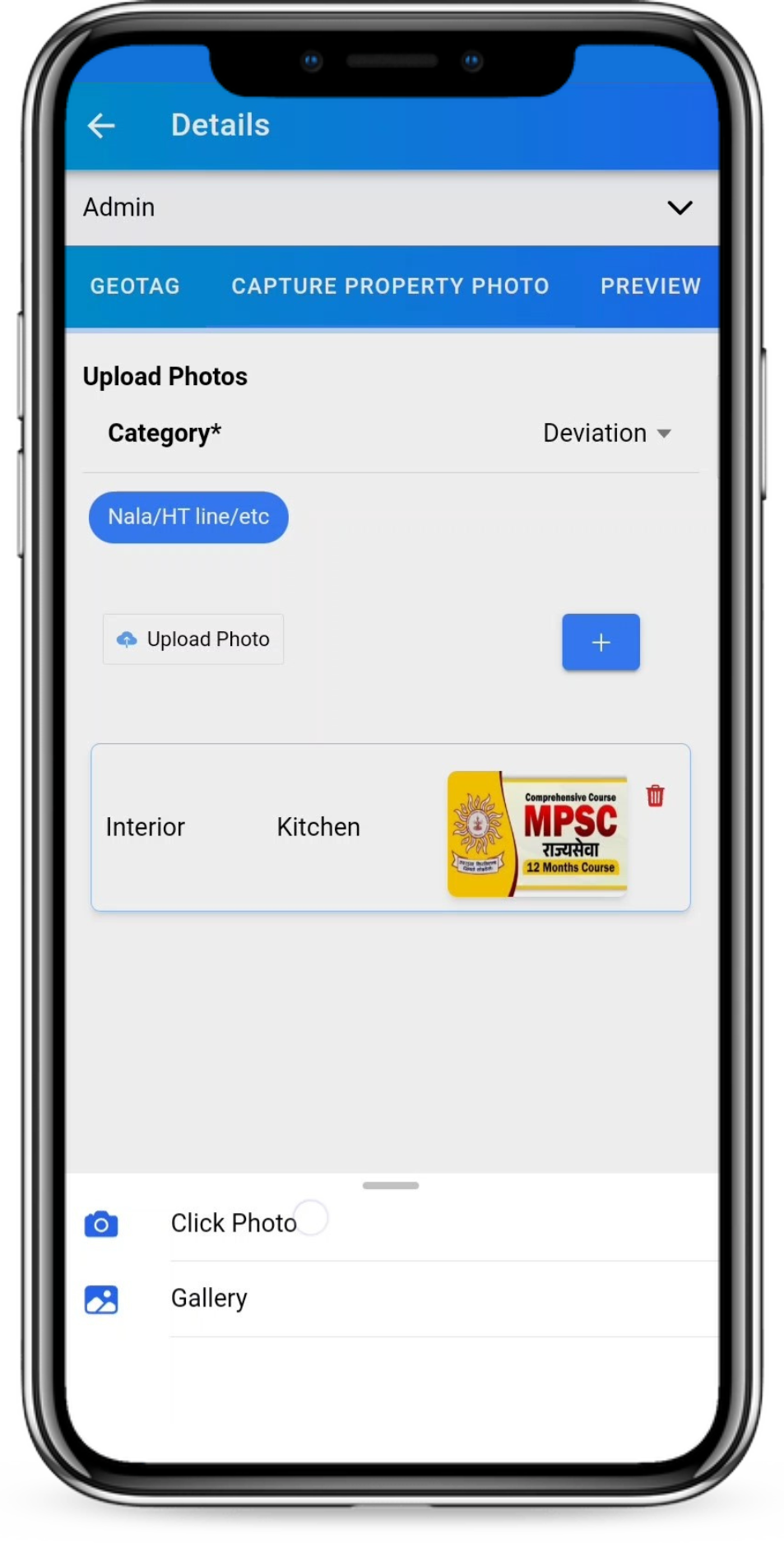

Conduct site visits and capture necessary photographs.

Conduct site visits and capture necessary photographs.

Input data directly into the application during fieldwork.

Input data directly into the application during fieldwork.

Submit collected data for review by valuation authorities.

Submit collected data for review by valuation authorities.

5) Case Management and Monitoring

Track the lifecycle of each case from assignment to report submission.

Track the lifecycle of each case from assignment to report submission.

Monitor the performance of field executives and valuers.

Monitor the performance of field executives and valuers.

Maintain a centralized repository of all cases and their associated reports.

Maintain a centralized repository of all cases and their associated reports.

6) Report Generation

Automated generation of valuation reports tailored to each bank's required format

Automated generation of valuation reports tailored to each bank's required format

Reports include comprehensive details of the property, valuation findings, and

supporting evidence.

Reports include comprehensive details of the property, valuation findings, and

supporting evidence.

Workflow Overview

1) Case Assignment:

Bank assigns a property valuation request to a valuer via the portal.

Bank assigns a property valuation request to a valuer via the portal.

Valuer assigns the case to a field executive for site inspection.

Valuer assigns the case to a field executive for site inspection.

2) Field Inspection:

The field executive visits the site, captures photos, and enters data via the mobile

app.

The field executive visits the site, captures photos, and enters data via the mobile

app.

Data is synced with the admin panel for review.

Data is synced with the admin panel for review.

3) Valuation and Review:

Valuer reviews field data and performs property valuation.

Valuer reviews field data and performs property valuation.

Multi-level reviews are conducted if needed.

Multi-level reviews are conducted if needed.

Provision for revisits to gather additional information.

Provision for revisits to gather additional information.

4) Report Submission:

Valuation report is generated in the required format and submitted to the bank via

the portal.

Valuation report is generated in the required format and submitted to the bank via

the portal.

Bank reviews the report and takes further action.

Bank reviews the report and takes further action.

Benefits of the Solution

Enhanced Collaboration: Facilitates seamless communication and data sharing

among

banks, valuers, and field executives.

Enhanced Collaboration: Facilitates seamless communication and data sharing

among

banks, valuers, and field executives.

Improved Efficiency: Mobile-enabled workflows reduce turnaround times for

property valuations.

Improved Efficiency: Mobile-enabled workflows reduce turnaround times for

property valuations.

Role-Based Access: Ensures secure handling of sensitive data through role-specific

permissions.

Role-Based Access: Ensures secure handling of sensitive data through role-specific

permissions.

Customizable Reporting: Generates bank-specific reports to meet unique requirements.

Customizable Reporting: Generates bank-specific reports to meet unique requirements.

Comprehensive Monitoring: Provides end-to-end visibility into case progress and field operations.

Comprehensive Monitoring: Provides end-to-end visibility into case progress and field operations.

Conclusion

Our IBC/Survey/Election Voting Platform provides a comprehensive solution for secure and efficient voting processes. With features designed to meet the unique needs of professionals and organizations, we offer a platform that combines simplicity, flexibility, and reliability. Choose us as your trusted partner to experience the excellence and transparency that our solution brings to the voting process.

We look forward to discussing this proposal further and tailoring the platform to meet your specific requirements. Please reach out for a demonstration or additional inquiries.