Introduction

We are pleased to propose an end-to-end digitization solution designed for government authorities to streamline tax collection, report generation, and data analysis. This software is a robust system that simplifies the management of establishment registrations, tax payments, notices, and certifications. By automating critical processes, it ensures compliance, enhances transparency, and supports data-driven decision-making.

Key Features and Modules

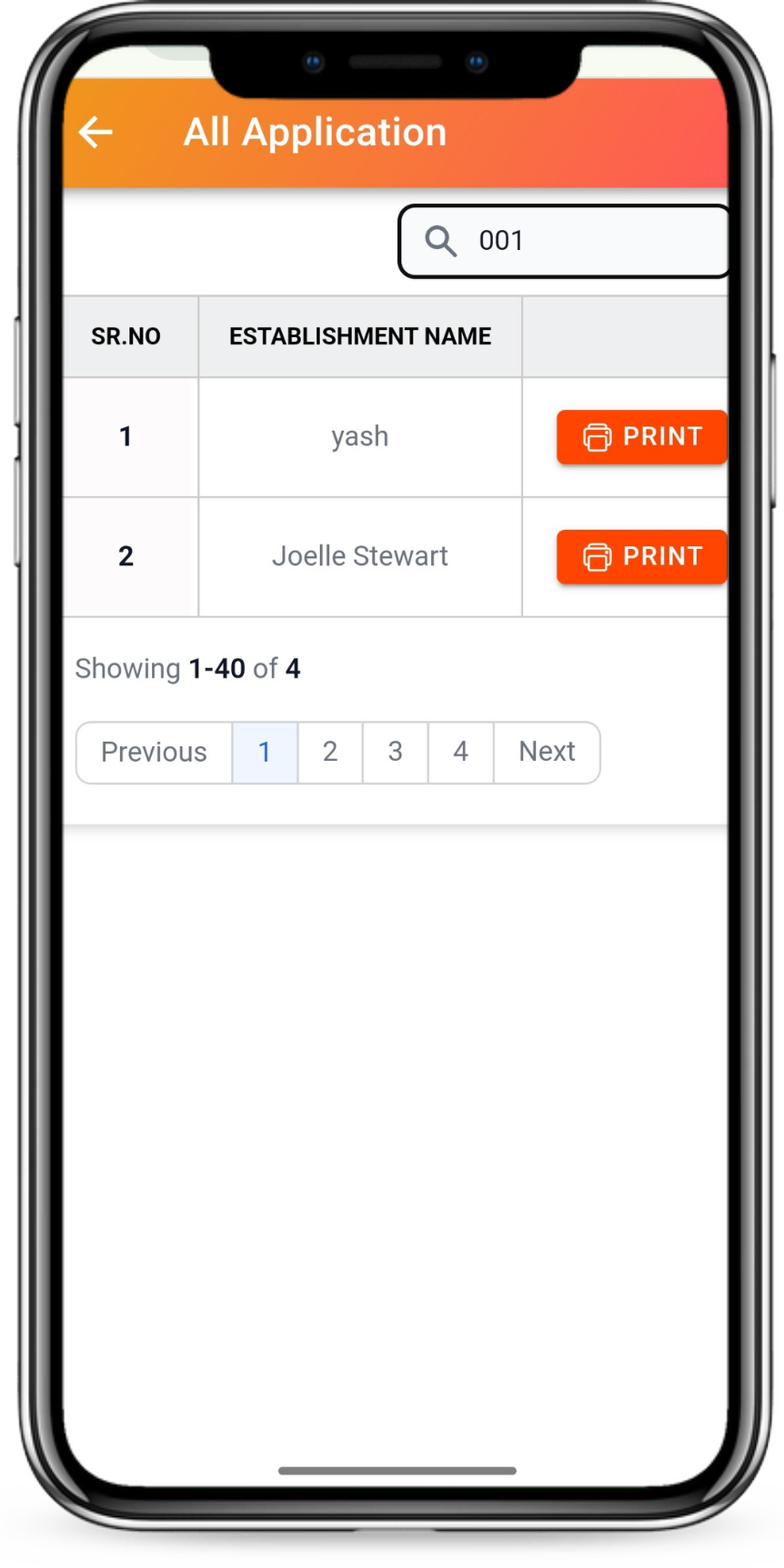

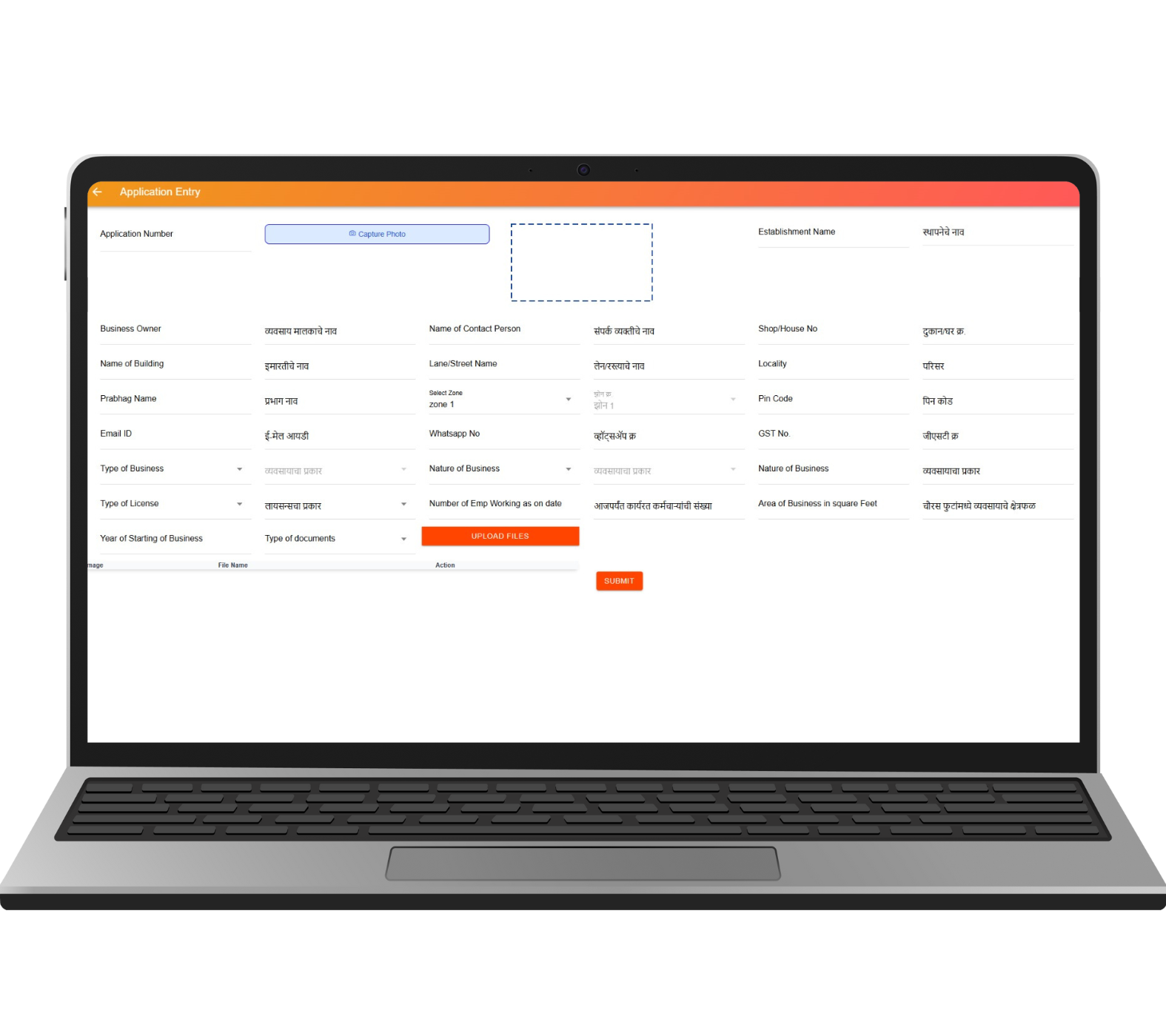

1) Establishment Registration Module

Seamless registration of establishments based on their business type and location.

Seamless registration of establishments based on their business type and location.

Automatic classification and categorization as per council-defined criteria.

Automatic classification and categorization as per council-defined criteria.

2) Automated Notice Generation

Automatic generation of tax notices as per council-defined rates.

Automatic generation of tax notices as per council-defined rates.

Escalating notice system with three levels: Notice 1, Notice 2, and Notice 3.

Escalating notice system with three levels: Notice 1, Notice 2, and Notice 3.

Penalty notices generated for non-compliance.

Penalty notices generated for non-compliance.

3) Tax Payment Options

Real-time updates of payment status and receipts.

Real-time updates of payment status and receipts.

Flexibility to pay taxes offline at designated offices or online through a secure

payment gateway.

Flexibility to pay taxes offline at designated offices or online through a secure

payment gateway.

4) Renewal Module

Provision for users to renew certifications through a web application.

Provision for users to renew certifications through a web application.

Automated reminders for upcoming renewals.

Automated reminders for upcoming renewals.

5) Web Application for Users

User-friendly interface for tax payments, certification renewals, and accessing

notices.

User-friendly interface for tax payments, certification renewals, and accessing

notices.

Secure login for viewing payment history, notices, and renewal status.

Secure login for viewing payment history, notices, and renewal status.

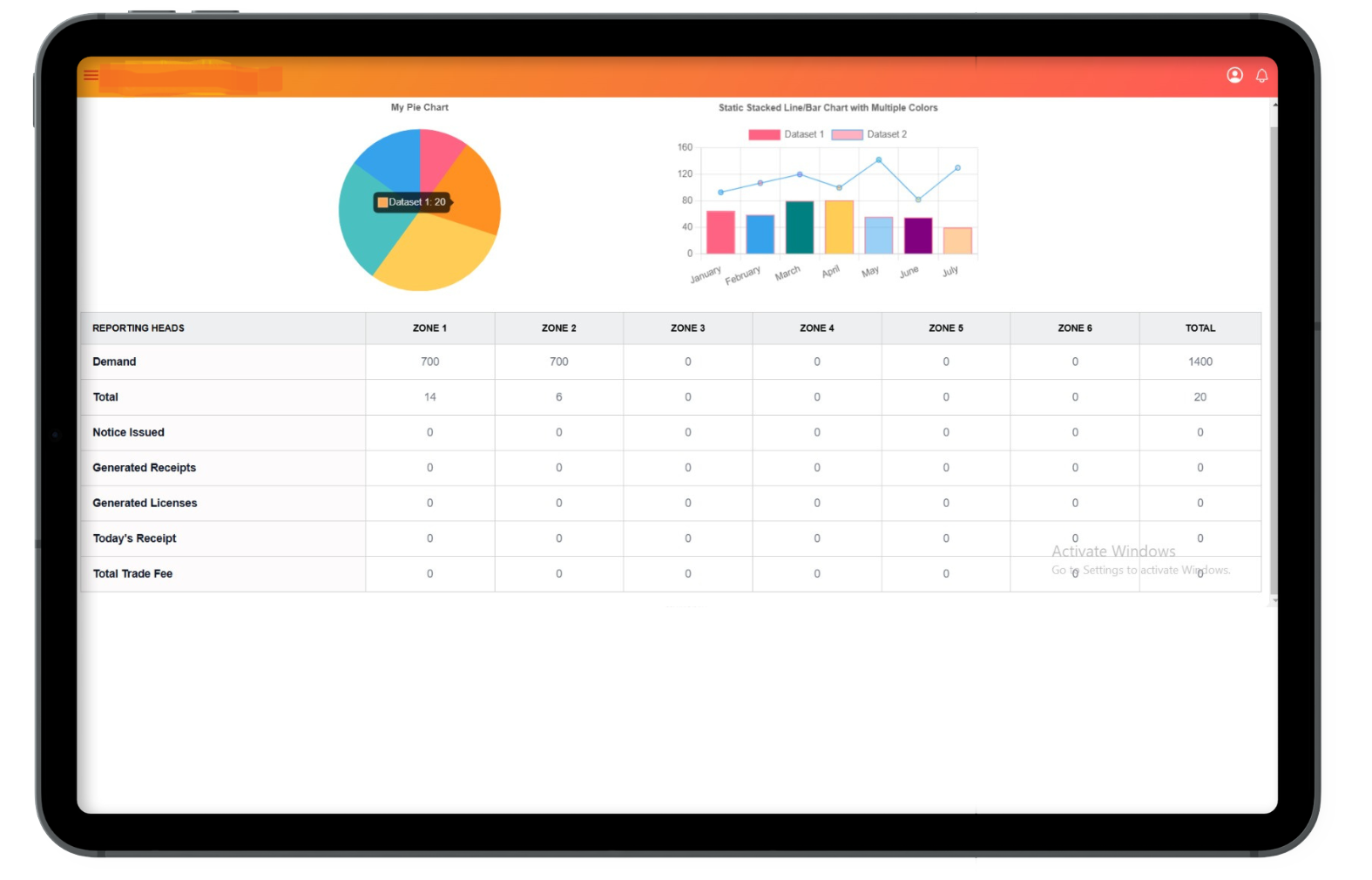

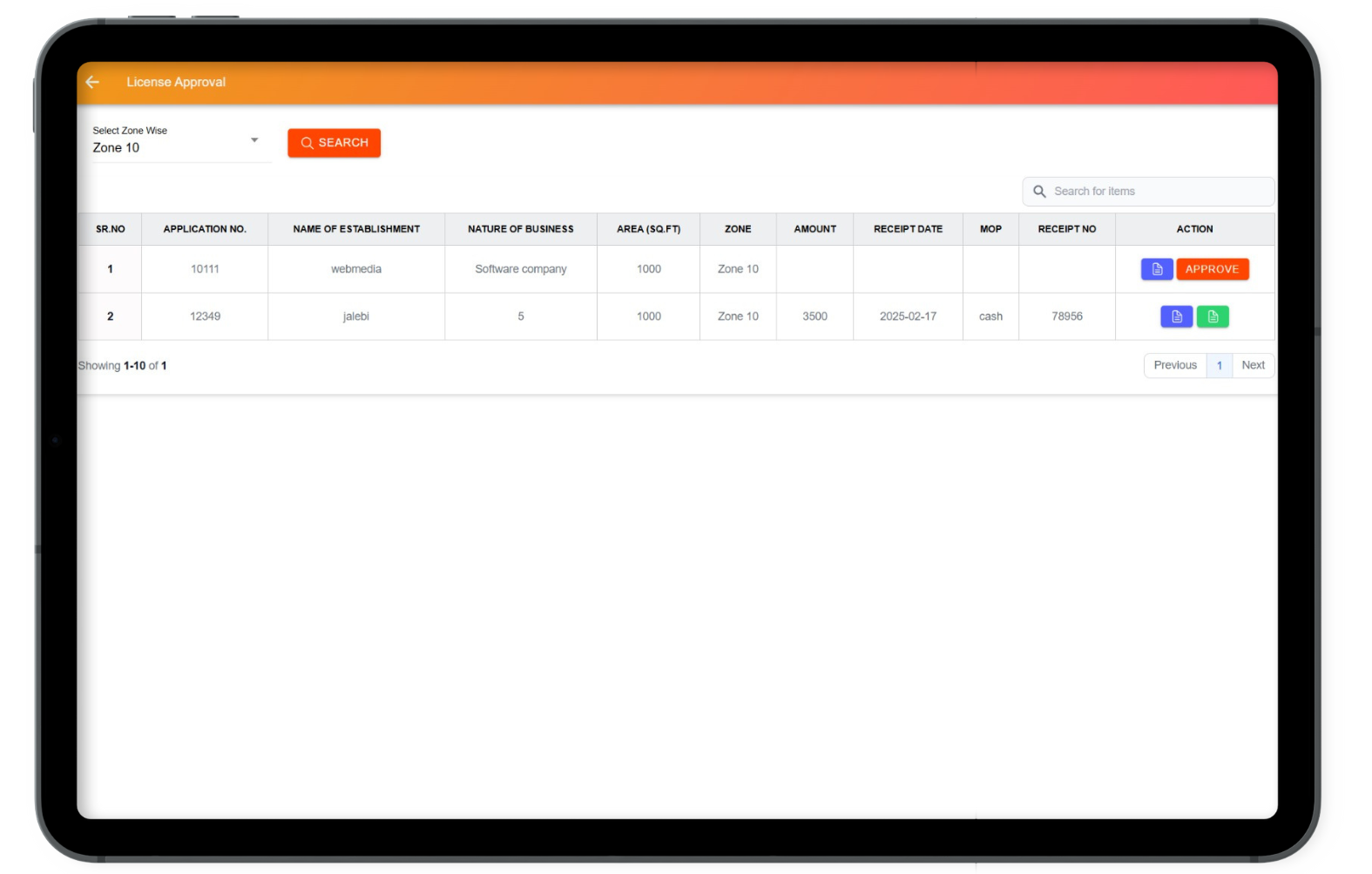

6) Admin Panel for Local Authorities

Real-time monitoring and management of tax collection and notices.

Real-time monitoring and management of tax collection and notices.

Tools for managing establishment registrations, tax escalations, and penalties.

Tools for managing establishment registrations, tax escalations, and penalties.

Comprehensive dashboard with key performance indicators.

Comprehensive dashboard with key performance indicators.

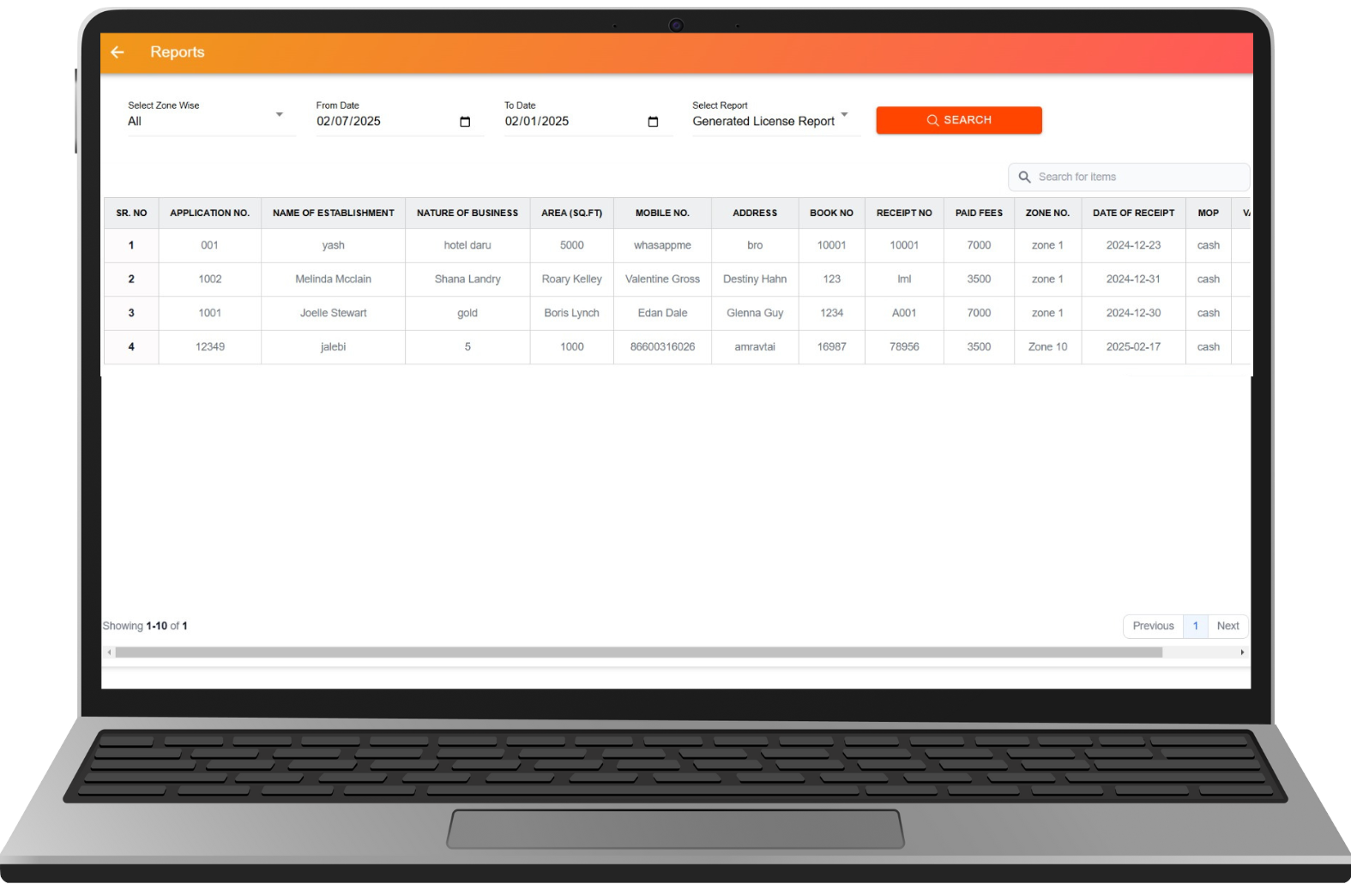

7) Reporting and Data Analysis

Zone-wise, ward-wise, and area-wise data collection and analysis.

Zone-wise, ward-wise, and area-wise data collection and analysis.

Detailed reporting for establishment surveys, tax compliance, and revenue trends.

Detailed reporting for establishment surveys, tax compliance, and revenue trends.

Tools for generating insights to support decision-making and policy formulation.

Tools for generating insights to support decision-making and policy formulation.

Benefits to Government Authorities

Efficiency: Automated processes reduce manual work and errors, ensuring

timely notice generation and tax collection.

Efficiency: Automated processes reduce manual work and errors, ensuring

timely notice generation and tax collection.

Transparency: Clear records and secure online payments foster trust and

accountability.

Transparency: Clear records and secure online payments foster trust and

accountability.

Data-Driven Insights: Advanced analytics empower authorities to make informed

decisions.

Data-Driven Insights: Advanced analytics empower authorities to make informed

decisions.

Compliance: Structured escalation and penalty systems ensure adherence to tax

regulations.

Compliance: Structured escalation and penalty systems ensure adherence to tax

regulations.

Accessibility: User-friendly web applications make it convenient for

establishments to comply with their obligations.

Accessibility: User-friendly web applications make it convenient for

establishments to comply with their obligations.

Software Architecture

1) Admin Panel:

Centralized control for local authorities to monitor and manage operations.

Centralized control for local authorities to monitor and manage operations.

Tools for tracking tax payments, generating reports, and managing notices.

Tools for tracking tax payments, generating reports, and managing notices.

2) Web Application:

Secure authentication and intuitive navigation for ease of use.

Secure authentication and intuitive navigation for ease of use.

Designed for establishments to manage registrations, pay taxes, and renew

certifications.

Designed for establishments to manage registrations, pay taxes, and renew

certifications.

3) Automation Modules:

Dynamic notice generation based on business type and tax rates.

Dynamic notice generation based on business type and tax rates.

Automated escalation for non-compliance, including penalty notices.

Automated escalation for non-compliance, including penalty notices.

4) Reporting System:

Advanced reporting tools for analyzing zone-wise and ward-wise tax data.

Advanced reporting tools for analyzing zone-wise and ward-wise tax data.

Real-time updates and visualizations for actionable insights.

Real-time updates and visualizations for actionable insights.

Conclusion

This software solution is designed to revolutionize tax collection and reporting processes for government authorities. By integrating automation, advanced analytics, and user-friendly interfaces, it will enhance operational efficiency, ensure compliance, and provide valuable insights for policy-making.

We look forward to discussing how this solution can be customized to meet your specific needs. Please feel free to reach out with any questions or to schedule a demonstration.